Revocable Living Trusts Can Be A Valuable Tool

In its most basic form, a revocable living trust is just a legal contract that you make with yourself to create an entity to hold your assets.

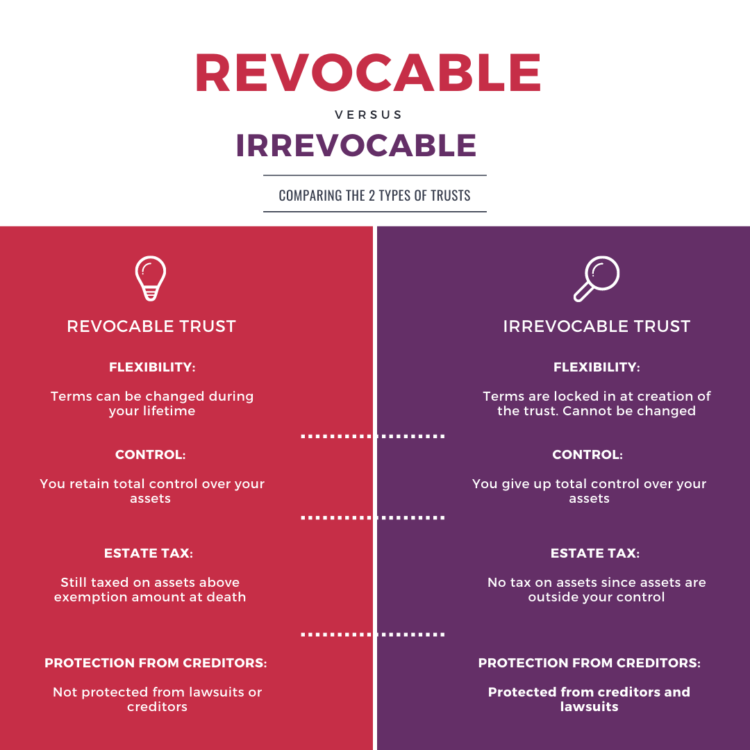

A revocable living trust can be set up so you can change it at any time in your life (that’s why they are called ‘revocable’) or so that you can’t change very much about it at all (these are irrevocable living trusts).

A revocable living trust can outlive you, manage your assets, and make sure that your family and friends get what you wanted them to have, when you wanted them to have it.

7 Benefits A Living Trust Offers

There are several reasons to consider creating a living trust, which is also called a revocable trust. Here are the top seven.

1. A Living Trust Eliminates The Need For A Conservatorship

If you become incapacitated and can’t make financial decisions and pay bills, your living trust will work as a directive for what should happen. This means you can often avoid having a loved one pursue a costly and time-consuming court appointed conservatorship. In a living trust, the successor trustee you’ve named can manage your affairs. There is no need for the court to get involved.

2. A Living Trust Avoids Probate

Although there will be the need to perform a trust administration after your death, the assets in your living trust avoid the delay and cost associated with the probate process.

3. A Living Trust Provides Privacy

Because a living trust avoids probate, it provides privacy. When going through the probate process, the details are made public and what assets you left to loved ones can be viewed by anyone. They do not even need a good reason. They could be neighbors or relatives or worse yet, they could be scam artists.

4. A Living Trust Allows You To Restrict How Your Estate Is Managed And Spent After Your Death

It can provide for your children’s educational and other needs by directing your assets to go to them when they reach a certain age. You can even provide that your children should start receiving income from your living trust at 18 but that they receive the principal in graduated stages. For example: one-third of the principal at 21, one-third at 25 and one-third at 30.

5. A Living Trust Can Protect Children From Their Creditors And Ex-Spouses

A living trust can leave your assets to your children in a manner that will reduce the ability of their creditors or ex-spouses to take your children’s inheritance from them.

6. A Living Trust Can Ensure That Your Wishes Are Clear To All

Most well-drafted living trusts include a “no-contest clause.” This prevents greedy beneficiaries and their lawyers from successfully contesting your estate plan in most cases.

7. A Living Trust Gives You Peace Of Mind

After creating a living trust you can rest easy knowing that your estate will be taken care of by someone you named and trust to carry out your wishes.

If I Have A Revocable Living Trust, Do I Still Need A Will?

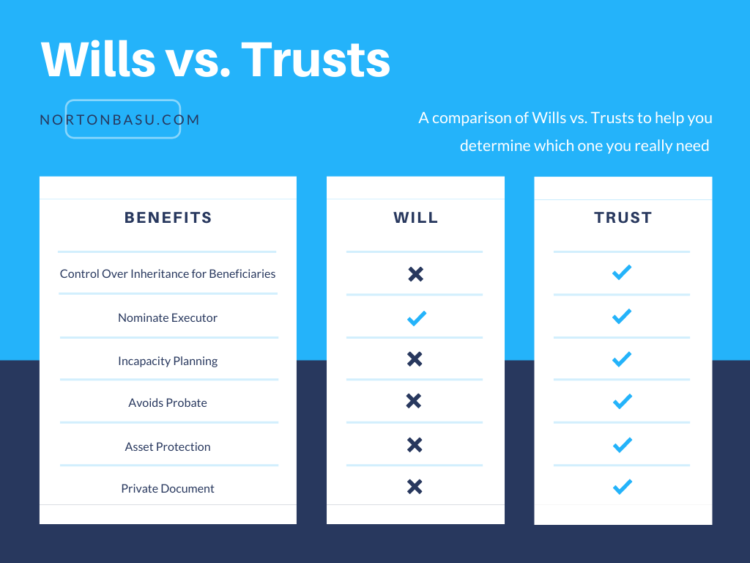

The short answer is yes. When you have a living trust, the private living trust document holds all the key information about what you have and to whom you want to give it. The will created in conjunction with your living trust is called a pour-over will. This type of will holds very little detail about your assets or about your beneficiaries.

The pour-over will tells the probate court (because all wills are to be filed in probate court after you pass on) that all your assets that are outside the living trust should be ‘poured over’ into the living trust and distributed as per the terms of your living trust. Effectively, this will is a backup document to your living trust.

How Do I Create A Revocable Living Trust?

The first step is to make an appointment for a free, no-obligation meeting with one of our estate planning professionals. Once you decide to proceed with us, you should be prepared to discuss the following issues:

- How your assets are to be distributed after your death or during your lifetime, such as annual monetary gifts to family or grandchildren, for example.

- The names of the people or person you want to manage your assets if you become incapacitated.

- Who should be in charge of your affairs after your death.

We can educate you as to your options and answer all of your questions. We tailor each plan to the individual or couple creating it and their goals.

Work With A Team Of Estate Planning Professionals

At Norton Basu LLP, we offer personal service. When you work with us, we focus on you and your situation and goals so that you receive tailored planning. Call 408-520-1712 and set up a meeting. You can also send the firm a get-in-touch email, and we will get in touch with you. Real People. Real World Advice. Real Results.